Summer is now officially over, and we are heading into the home stretch when it comes to 2017. I continue to make great progress when it comes to my net worth, with gains across the board. The largest increase was in my Roth IRA with both of my 401k accounts coming in close behind. I received a nice bonus in my HSA account this month after going for my yearly doctor’s appointment and blood work, so that was a good boost as well. The important thing is that I’m continuing to make progress in the right direction. I hope that everyone reading also had a successful month financially!

Summer is now officially over, and we are heading into the home stretch when it comes to 2017. I continue to make great progress when it comes to my net worth, with gains across the board. The largest increase was in my Roth IRA with both of my 401k accounts coming in close behind. I received a nice bonus in my HSA account this month after going for my yearly doctor’s appointment and blood work, so that was a good boost as well. The important thing is that I’m continuing to make progress in the right direction. I hope that everyone reading also had a successful month financially!

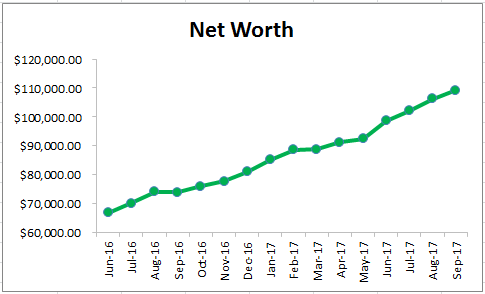

Here is September’s net worth:

It’s crazy to think that I just hit $100,000 back in July and now I’m pushing to be $10,000 higher than that by next month. And that’s only in three months! It’s showing me in real time that the market is the powerful force here, though my contributions still make a huge difference. I can’t wait to be at the point where my contributions are just a drop in the bucket and the gains from the market are what really move things along here.

It’s crazy to think that I just hit $100,000 back in July and now I’m pushing to be $10,000 higher than that by next month. And that’s only in three months! It’s showing me in real time that the market is the powerful force here, though my contributions still make a huge difference. I can’t wait to be at the point where my contributions are just a drop in the bucket and the gains from the market are what really move things along here.

So let’s see how far my assets would actually take me at this point in time. I’m going to calculate that using my average spending over the last 12 months. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

So let’s see how far my assets would actually take me at this point in time. I’m going to calculate that using my average spending over the last 12 months. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

$2642 average spending last 12 Months * 12 Months = $31,704 spending in a year

$109,181 net worth / $31,704 spending per year = 3.44 years worth of spending

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years. I’d be able to withdraw $519 a month for 30 years which is 19.6% of my average monthly spending.

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years. I’d be able to withdraw $519 a month for 30 years which is 19.6% of my average monthly spending.

Leave a Reply