Happy Halloween everyone, hope it was full of lots of treats and no tricks! Time to lay off the sugar for a little while. I think Halloween was my first introduction to taxes when I was younger, with my parents taking a “parent tax” of their favorite candy. It’s no wonder I’m still trying to pay less taxes to this day! No big news for me in October, but I continue to increase my net worth at an excellent pace. I’m hoping that I’ll be able to continue to push that same progress in both November and December.

Happy Halloween everyone, hope it was full of lots of treats and no tricks! Time to lay off the sugar for a little while. I think Halloween was my first introduction to taxes when I was younger, with my parents taking a “parent tax” of their favorite candy. It’s no wonder I’m still trying to pay less taxes to this day! No big news for me in October, but I continue to increase my net worth at an excellent pace. I’m hoping that I’ll be able to continue to push that same progress in both November and December.

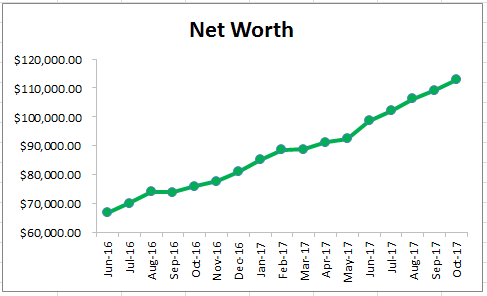

Here is my net worth at the end of October:

It was another really solid month for me, in terms of both savings and the market’s impact. All my accounts across the board were on the positive side. Another thing that I’m really happy is that I finally seem to balancing my checking account, closer to net zero spending. That means that money is going straight into tax advantaged accounts, instead of accumulating in my checking account.

It was another really solid month for me, in terms of both savings and the market’s impact. All my accounts across the board were on the positive side. Another thing that I’m really happy is that I finally seem to balancing my checking account, closer to net zero spending. That means that money is going straight into tax advantaged accounts, instead of accumulating in my checking account.

This has always been a problem for me, I think I’m a bit over-cautious when it comes to an emergency fund. I still feel like I have too much cash sitting around, especially when not looking to save up for any big purchases at the moment. I bumped up my 401k contributions by another percent, and it looks like I’m getting closer to that balance. I’ll continue to track this, but I’m thinking that I’ll need to increase that by another percent. I’m already maxing out my Roth IRA and HSA, so there’s no real room for additional savings there.

So let’s see how far my assets would actually take me at this point in time. I’m going to calculate that using my average spending over the last 12 months. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

So let’s see how far my assets would actually take me at this point in time. I’m going to calculate that using my average spending over the last 12 months. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

$2647 average spending last 12 Months * 12 Months = $31,769 spending in a year

$112,906 net worth / $31,769 spending per year = 3.55 years worth of spending

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years. I’d be able to withdraw $537 a month for 30 years which is 20.3% of my average monthly spending.

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years. I’d be able to withdraw $537 a month for 30 years which is 20.3% of my average monthly spending.

I continue to increase my spending power, even if it was only by a tiny bit this month. Spending was higher than expected this month, but it was for a good reason. I’ve finally been able to switch my car insurance for significant savings! But I did have to pay 6 months up front, but I’ll be saving around $400 across the year. I expect those savings to show up in the budget for the next few months, dropping my average spending a bit.

I’ve also hit my goal of covering 20% of my expenses, but being able to cover 25% by the end of the year might be tough. The car insurance up front payment probably delayed that by a bit! Not a big deal though, as I continue to make progress in the right direction.

Bookmark the permalink.