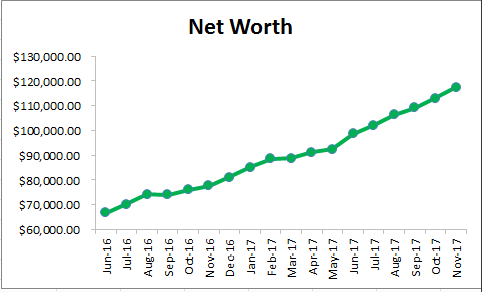

It’s time for another net worth update, one of my favorite things to do! I guess that also stems from the fact that I’m riding on a long streak of net worth increases month after month. I hope that everyone reading in the US had a great Thanksgiving. It was another great month for me as we head towards the end of 2017. To me it really feels like we were just in Summer, and now we’re smack in the middle of a (cold) Winter. December is off to a good start financially for me as well, and I’ve started working on a new monthly post that I’ll be bringing you later this month – so stay tuned! For now, let’s take a look at my financial progress this past month.

It’s time for another net worth update, one of my favorite things to do! I guess that also stems from the fact that I’m riding on a long streak of net worth increases month after month. I hope that everyone reading in the US had a great Thanksgiving. It was another great month for me as we head towards the end of 2017. To me it really feels like we were just in Summer, and now we’re smack in the middle of a (cold) Winter. December is off to a good start financially for me as well, and I’ve started working on a new monthly post that I’ll be bringing you later this month – so stay tuned! For now, let’s take a look at my financial progress this past month.

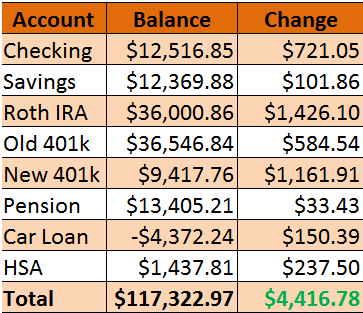

My current net worth as of November 2017:

This was another good month for me as I talked about earlier. Checking account balance increased a little bit more than I would have liked. If you’re a long time reader, you’ll know that is something that I’ve been struggling with for a long time. Having money sit in there (past my emergency fund amount) is an inefficient use of money and I’ve been bumping up my 401k contributions to counteract that.

This was another good month for me as I talked about earlier. Checking account balance increased a little bit more than I would have liked. If you’re a long time reader, you’ll know that is something that I’ve been struggling with for a long time. Having money sit in there (past my emergency fund amount) is an inefficient use of money and I’ve been bumping up my 401k contributions to counteract that.

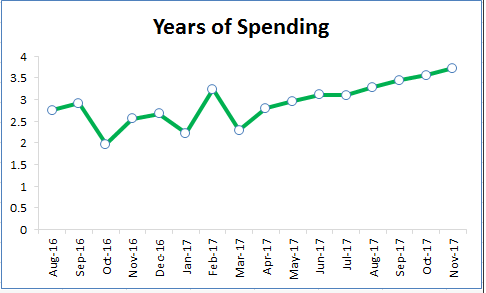

So let’s see how far my assets would actually take me at this point in time. I’m going to calculate that using my average spending over the last 12 months. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

So let’s see how far my assets would actually take me at this point in time. I’m going to calculate that using my average spending over the last 12 months. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

$2629 average spending last 12 Months * 12 Months = $31,548 spending in a year

$117,322 net worth / $31,548 spending per year = 3.72 years worth of spending

I’m closing in on hitting 4 years worth of spending, and that calculation is not factoring in any market gains or dividends during the time I’m withdrawing that money. It’s just a straight division based on the money I have saved up. I also think that using my average spending has led to a much better calculation and visualization over time, with my years of spending slowly trending up now.

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years.

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years.

I’d be able to withdraw $558 a month for 30 years which is 21.2% of my average monthly spending.

Leave a Reply