May was another good month for me financially, keeping with the positive trends in most categories. Spending was up this month slightly, but that didn’t seem to affect my overall savings rate and I still posted a positive net worth gain. Most of the increases in spending were due to booking vacations for the Summer along with more general travel expenses. It seems like if I continue this pace, a $150,000 net worth is just right around the corner.

May was another good month for me financially, keeping with the positive trends in most categories. Spending was up this month slightly, but that didn’t seem to affect my overall savings rate and I still posted a positive net worth gain. Most of the increases in spending were due to booking vacations for the Summer along with more general travel expenses. It seems like if I continue this pace, a $150,000 net worth is just right around the corner.

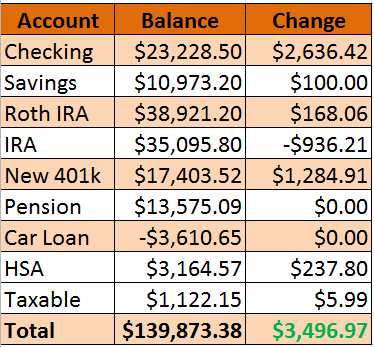

Here is my net worth after May:

Once again, the biggest gains are both in my checking account and my new 401k. The goal will continue to be trying to keep that checking account number down or even, and to keep the cash moving into 401k/IRA/HSA as I try to increase my savings rate.

That’s two consistent months of gains in my net worth, and you can see that affect on the chart. It’s nice to see it rising with a steeper slope recently.

That’s two consistent months of gains in my net worth, and you can see that affect on the chart. It’s nice to see it rising with a steeper slope recently.

So let’s see how far my assets would actually take me at this point in time. I’m going to calculate that using my average spending over the last 12 months. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

$2635 average spending last 12 Months * 12 Months = $31,625 spending in a year

$139,873 net worth / $31,625 spending per year = 4.42 years worth of spending

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years.

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years.

I’d be able to withdraw $665 a month for 30 years which is 25.2% of my average monthly spending.

Another small bump in percent this month, mostly due to the fact that spending actually increased. I’m setting my target to hit 30% of my average monthly spending by the end of the year. Anything else towards the stretch goal of 35% will just be a bonus.

Leave a Reply