I have to continue to apologize for the lack of frequent updates, but I am still here and trying to chug along. Even though I may not be publicly showing it, I am keeping track of my finances and trying to stay on top of my goals. For now the goal is to save as much as possible within the constraints of my budget, but also making sure that I’m still able to enjoy myself. I think that I’m finding a nice balance between the two and the increases in my net worth are really showing that. It doesn’t hurt that the market has been trending up, though the past week has halted that progress.

I have to continue to apologize for the lack of frequent updates, but I am still here and trying to chug along. Even though I may not be publicly showing it, I am keeping track of my finances and trying to stay on top of my goals. For now the goal is to save as much as possible within the constraints of my budget, but also making sure that I’m still able to enjoy myself. I think that I’m finding a nice balance between the two and the increases in my net worth are really showing that. It doesn’t hurt that the market has been trending up, though the past week has halted that progress.

Here is my net worth for January:

I think this was a great month for me, increases all across the board. I made the first contribution to my Roth IRA for 2017, and for now I plan to make monthly contributions spread throughout the year. I’m also eligible to contribute to a HSA this year so I’ll be looking into that as another way to decrease my taxable income.

I think this was a great month for me, increases all across the board. I made the first contribution to my Roth IRA for 2017, and for now I plan to make monthly contributions spread throughout the year. I’m also eligible to contribute to a HSA this year so I’ll be looking into that as another way to decrease my taxable income.

As you can see, both my checking and savings accounts have surged in size, and since I’m not actively saving for a down payment or anything of that nature I’m starting to feel like its way too much money that isn’t working for me. I’ve yet to open a taxable investment account, because I think the first step would be increasing my 401k contributions as those earnings are tax-free at this point in time.

Real life has been a bit chaotic for me, so with constantly changing budgets and unexpected expenses I’ve held off on doing that. I’d rather have the extra cash on hand at this point in time, instead of going directly into my 401k before I can even touch the money. I’m hoping that things will be more stable in the coming months so that I will be able to make that decision. For now, I’m able to stash any extra money away in the Roth IRA and (soon) the HSA account.

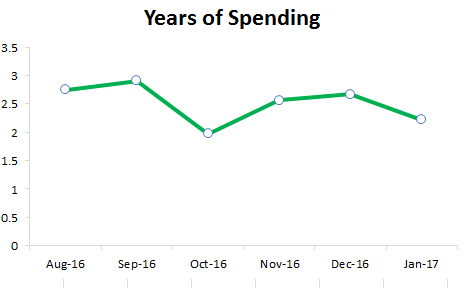

So let’s see how far my assets would actually take me at this point in time. I’m going to use my total spending from the previous month to calculate this. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

So let’s see how far my assets would actually take me at this point in time. I’m going to use my total spending from the previous month to calculate this. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

$3199 spending in December 2016 * 12 Months = $38,388 spending in a year

$85,150 net worth / $38,388 spending per year = 2.22 years worth of spending

Even with that huge net worth increase in January, the increased spending in December cancels that out quickly. I did go on a cruise last month though, so that’s to be expected. If you took away that one time vacation expense, I probably would have broken 3 years worth of spending at this point. Instead I ended up at my second lowest point (1.97 years in October 2016). But there’s always next month!

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years. I’d be able to withdraw $405 a month for 30 years which is 12.7% of my spending of the previous month. That’s another lower amount, but once again it’s not because a lack of saving – it’s because of my spending increased in December. I’m really starting to see the relationship between the two and I think if I have a month with low spending, we will really see these numbers jump up.

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years. I’d be able to withdraw $405 a month for 30 years which is 12.7% of my spending of the previous month. That’s another lower amount, but once again it’s not because a lack of saving – it’s because of my spending increased in December. I’m really starting to see the relationship between the two and I think if I have a month with low spending, we will really see these numbers jump up.

Image Source: John Towner @ Unsplash

Leave a Reply