It’s been a long several months, seems like I’ve been in and out and visiting hospitals more than I’ve been at home. And while you may not have seen any actual blog post updates, I have been doing my best to keep track of all the numbers in the background with plans to release the posts with updates. April was a great month for me, receiving a bonus at work and boosting my net worth to the highest level after a few months of flat and little to no progress. Obviously my savings continued at the same pace, but the market was just not cooperating. This was a reversal of that trend!

It’s been a long several months, seems like I’ve been in and out and visiting hospitals more than I’ve been at home. And while you may not have seen any actual blog post updates, I have been doing my best to keep track of all the numbers in the background with plans to release the posts with updates. April was a great month for me, receiving a bonus at work and boosting my net worth to the highest level after a few months of flat and little to no progress. Obviously my savings continued at the same pace, but the market was just not cooperating. This was a reversal of that trend!

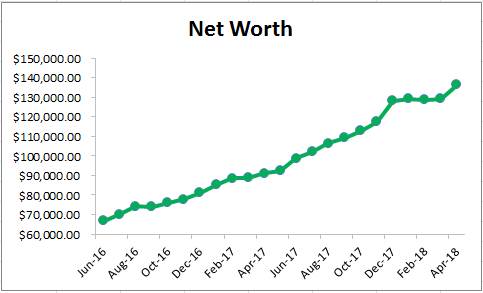

Here is my net worth after April:

As you can see, the biggest gains are in my checking account and my 401k thanks to the nice bonus that I received at work. You can also see that I was finally able to convert my old 401k into an IRA. I did lose a little bit of money from holding onto a check and processing time, but it will make it up for it with extremely low fees. The new fees that they were trying to charge were absurd, which caused the urgency to rollover into an IRA.

As you can see, the biggest gains are in my checking account and my 401k thanks to the nice bonus that I received at work. You can also see that I was finally able to convert my old 401k into an IRA. I did lose a little bit of money from holding onto a check and processing time, but it will make it up for it with extremely low fees. The new fees that they were trying to charge were absurd, which caused the urgency to rollover into an IRA.

The graph is moving up nicely now!

The graph is moving up nicely now!

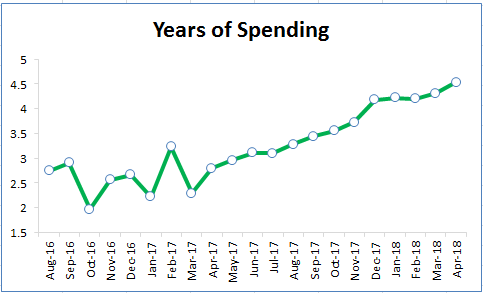

So let’s see how far my assets would actually take me at this point in time. I’m going to calculate that using my average spending over the last 12 months. I’ll then multiply that by 12 months to get the total spending for the year, and then divide my total net worth by that amount. That’s how long I’d be able to live off my savings at that point in time.

$2482 average spending last 12 Months * 12 Months = $29,784 spending in a year

$136,376 net worth / $29,784 spending per year = 4.58 years worth of spending

Moving on up here as well, crossing the 4.5 marker thanks to decreased spending and an increase in net worth this month.

I also thought it would be cool to see the opposite, how much would I be able to withdraw each month? I set the rate of return at 4% as a conservative guess, and the retirement time period would be for 30 years.

I’d be able to withdraw $621 a month for 30 years which is 25.0% of my average monthly spending.

I continue to bump this up ever so slightly, but I’m going to need some serious progress during the rest of the year to get to the goal of 35%. Things have mostly been back and forth this year, which wasn’t the case when I originally set the goal in January.

Almost 5 years worth of spending, good investments